MYLOANOFFICER.US

Get Online.

Establish New Leads.

Close More Loans.

Your Compliant Lead-Generation Website

The only turnkey, industry compliant, SEO-optimized website solution for Mortgage Professionals.

MYLOANOFFICER.US

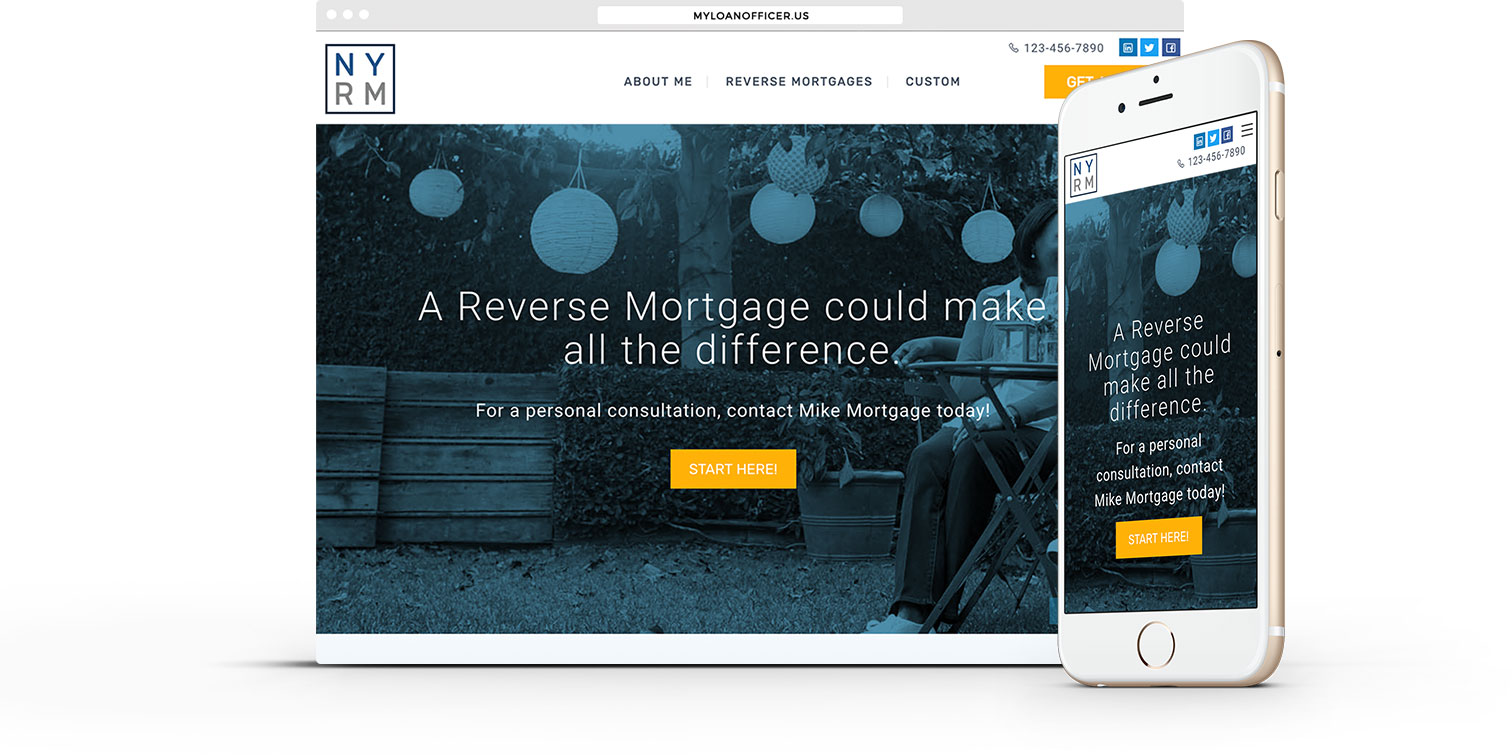

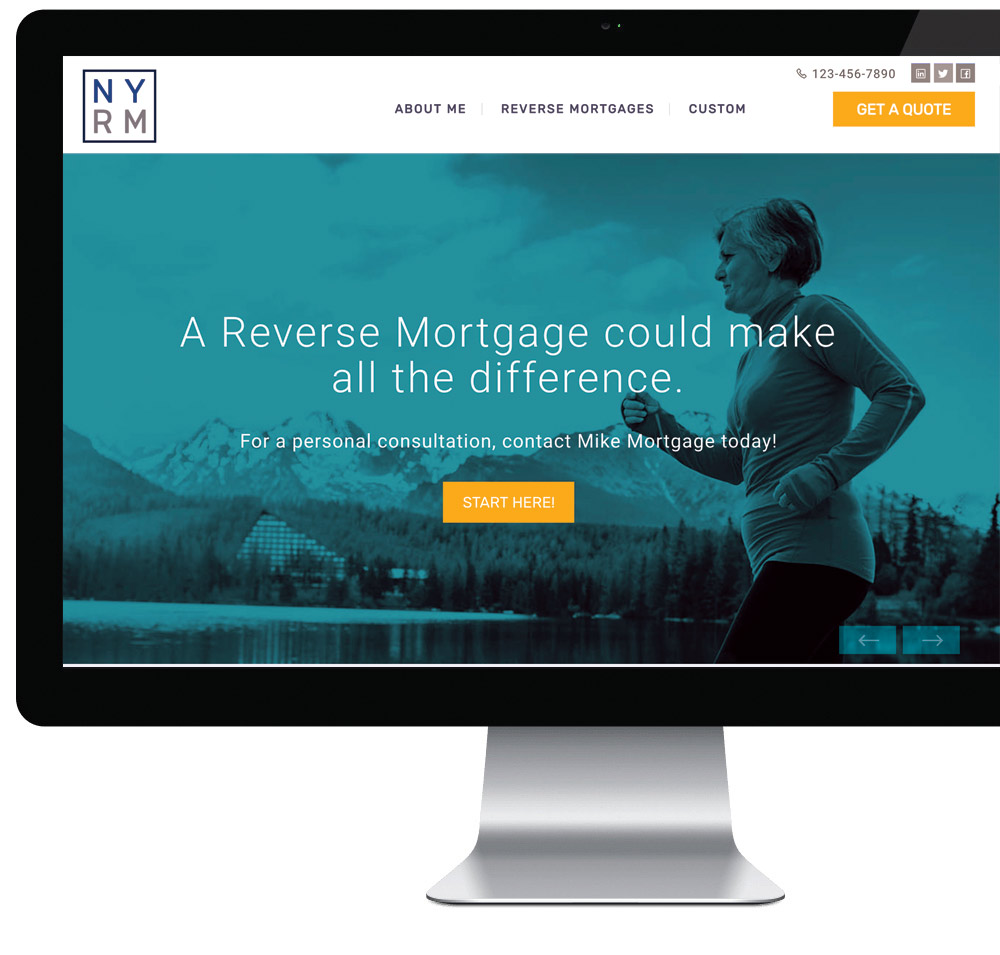

The only turnkey, industry compliant, SEO-optimized, blog-ready, mobile-responsive website solution built for Mortgage Professionals.

Loaded with a modernized lead funnel which injects leads from your website straight in Sales Engine CRM.

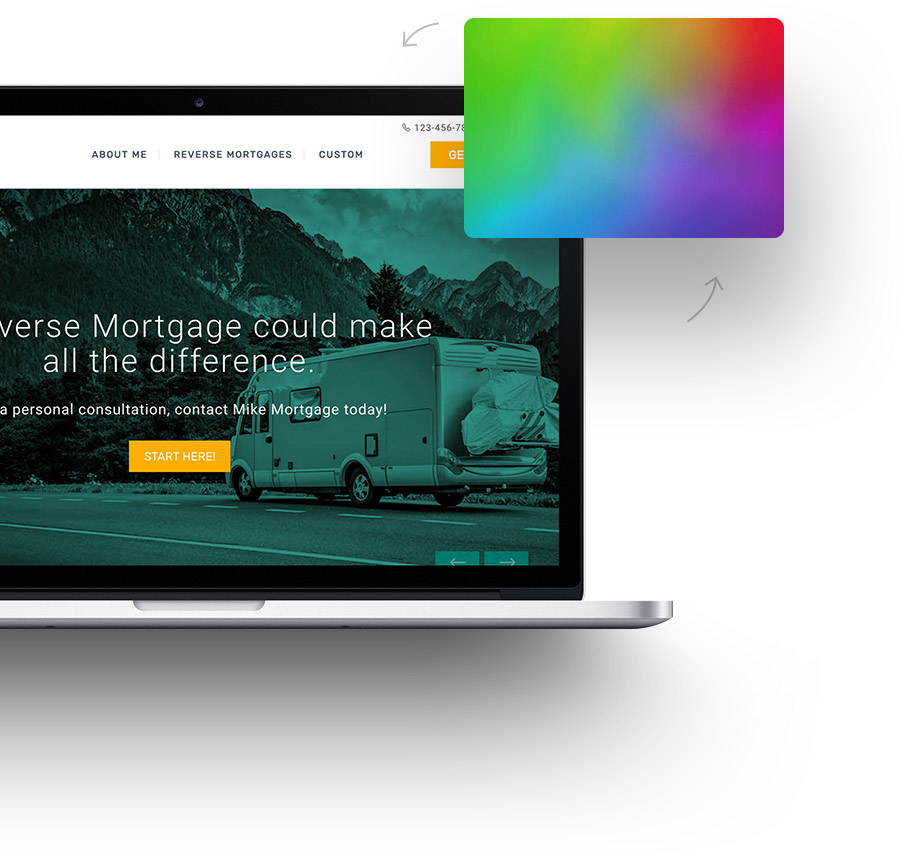

Reach borrowers with a sleek, compliant online presence that showcases your brand with unlimited color themes and robust customization to content and images.

0+

Pages of compliant, educational content.